german tax calculator in english

You can enter the gross wage as an annual or monthly figure. Submit your German tax return no tax knowledge needed simple interview questions helpful tips maximize your tax refund.

In the results table the calculator displays all tax deductions and contributions to mandatory social insurance on an annual and monthly basis.

. Your taxable worldwide income in FY 2021 is EUR 300000. German Income Tax Calculators for 202223. How much money will be left after paying taxes and social contributions which are obligatory for an employee working in Germany.

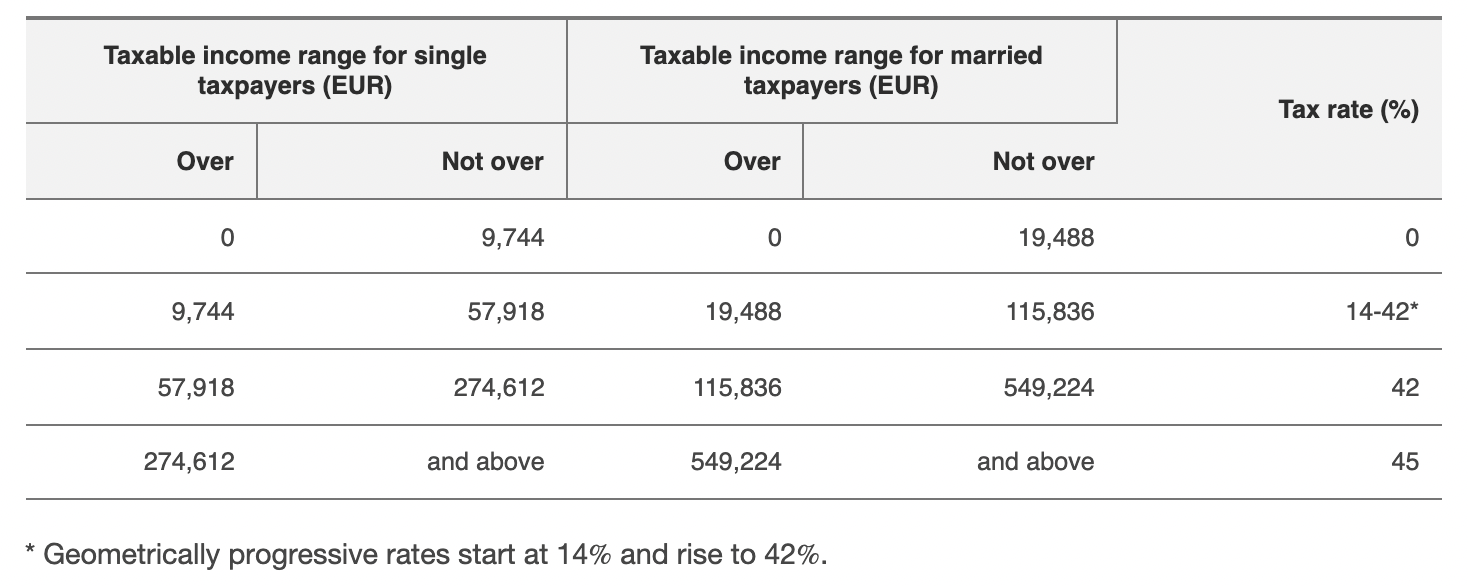

The basic principal is that income is divided between couples to calculate income tax liability. Income up to 9984 euros in 2022 is tax-free Grundfreibetrag. File your German tax return online Completely in English Less than 20 minutes Useful tips and support Average refund 1000 Euro.

German Income Tax Calculator Expat Tax. After this sum every euro you earn will be taxed with a higher percentage. Simply enter your annual or monthly income into the tax calculator above to find out how taxes in Germany affect your income.

Property sales tax Grunderwerbssteuer You will be liable to pay a property sales tax if you are buying a house in Germany. The amount depends on the individual income and on the state the person lives in. It starts with 14 when you earn 8130 EUR plus 100 EUR.

The maximum tax rate in Germany is 42 per cent. This one-off tax applies when a property valued at more than 2500 euros is transferred from one owner to another. Each income tax calculator allows for employment income expenses divided business and personal activity everything you will require to calculate your income tax return for 202223.

This could come under different forms. All employees along with apprentices and certain groups of self-employed people are obliged to have public pension insurance. The rate varies between federal states from 35 to 65 of the propertys value.

Register and discover how easy it is to get an average tax refund of more than 1000 Euro online. Just do your tax return with SteuerGo. Easy-to-use also without tax-knowledge.

Youll then get a breakdown of your total tax liability and take-home pay. The SteuerGo Gross Net Calculator lets you determine your net income. Singles can earn 8130 EUR per year tax free.

Zasta is a different kind of tax software as it serves as a platform to connect you to a professional tax advisor. Zasta translated by Google. The Federal Central Tax Office is responsible for handling the following procedures among others.

Married couples can double that sum. The money you have received from the German authorities need to be accounted for in the tax return made for 2020 and 2021. VAT inspection procedures in the EU allocation of VAT identification numbers confirmation procedures recapitulative statements VAT rebates for foreign businesses embassiesconsulates international organisations VAT on e-services.

Our grossnet calculator enables you to easily calculate your net wage which remains after deducting all taxes and contributions free of charge. It is a progressive tax ranging from 14 to 42. Calculate your Gross Net Wage - German Wage Tax Calculator.

Note 1 on 2022 German Income Tax Tables. EUR 12409437 total tax charge income tax SoliZ 4137. Calculating your income tax in German is simple simply select a specific online.

Yes all German residents are eligible to pay. Technically the tax deadline is on the 31st of July each year. The German tax year runs from January 1 to December 31.

You are a resident of Germany since 2020 irrespective of you citizenship. This section contains online income tax calculators for German. However if this falls on a weekend it will fall to the next working day.

Rentenversicherung pension insurance is the method of securing pension payments for retirement. This Income Tax Calculator is best suited if you only have income as self employed from a trade or from a rental property. Bavaria and Baden-Wurttemberg take 8 all other states take 9 of your income tax.

The German Annual Income Tax Calculator is updated to reflect the latest personal Tax Tables and German Social Insurance Contributions. The German Annual Income Tax Calculator for the 2022. Tax Calculation Example using an income tax calculator provided by the German Federal Ministry of Finance BMF.

All five software providers calculate an average tax return of more than 1000 euros. Income more than 58597 euros gets taxed with the highest income tax rate of 42. If your employer reduced your hours the German state has compensated for your lost income in the form of Kurzarbeit Geld.

This program is a German Income Tax Calculator for singles as well as married couples for the years 1999 until 2022. Salary Before Tax your total earnings before any taxes have been deducted. Best tax return software in Germany in English.

The first German tax return in English for all expats. If you wish to calculate your salary Social Insurance payments and income tax for a differant period please choose an alternate payment period or use the Advanced German Tax Calculator. User-friendly thanks to the intuitive questions.

This sum rises in 2014 to 8354 EUR. If you receive a salary only as an employee on a German payroll you get. You can enter your details on Zasta for free and you will get a pre-calculated tax return offer from a.

German tax burden for FY 2021. Our gross net wage calculator helps to calculate the net wage based on the Wage Tax System of Germany. The calculator covers the new tax rates 2022.

ESt 1 C - Cover sheet for limited taxpayers Mantelbogen für beschränkt Steuerpflichtige limited taxpayers are required to submit an annual tax return on their domestic income for the past calendar year assessment period unless the income tax is deemed to have been compensated by the tax deduction. Here are our top picks for the best tax return software in Germany in English. If you find this article or payroll taxation in Germany and supporting tax calculators and.

The so-called rich tax Reichensteuer of 45. In addition to calculating what the net amount resulting from a gross amount is our grossnet calculator can also calculate the gross wage that would yield a. As you can see above the tax allowance is double for a married person.

Geometrically progressive rates start at 14 and rise to 42. Integrated optimization checks a live tax refund calculator Check out our tax tool for free Get started Get started Receive an average tax refund of 1051 Source. However the church tax Kirchensteuer only applies to registered Catholics Protestants or Jewish.

Also known as Gross Income. If you are completing your tax return for 2021 it. They also offer to enter your data first so they function as a German tax refund calculator.

German Grossnet Calculator Wage Calculator for Germany. Further tips and instruction.

Personal Income Tax Solution For Expatriates Mercer

Personal Income Tax Solution For Expatriates Mercer

German Wage Tax Calculator Expat Tax

Capital Gains Tax Calculator Ey Us

Download Income Tax Calculator Fy 2021 22 Ay 2022 23 Income Tax Income File Income Tax

German Income Tax Calculator Expat Tax

How Does Germany Taxes Crypto How Much Tax Do You Pay On Crypto In Germany Is It Really Tax Free

Wix Stores Setting Up Manual Tax Calculation Help Center Wix Com

How To Estimate Your Taxes To Extend Filing Deadline Forbes Advisor

How To Create An Income Tax Calculator In Excel Youtube

German Income Tax Calculator Expat Tax

How To Calculate Foreigner S Income Tax In China China Admissions

Germany Crypto Tax Guide 2022 Koinly

You Should Know That Crypto Com Have Their Own Free Crypto Tax Calculator R Cryptocurrency

German Vat Calculator Vatcalculator Eu

How To Calculate Foreigner S Income Tax In China China Admissions